corporate card out there

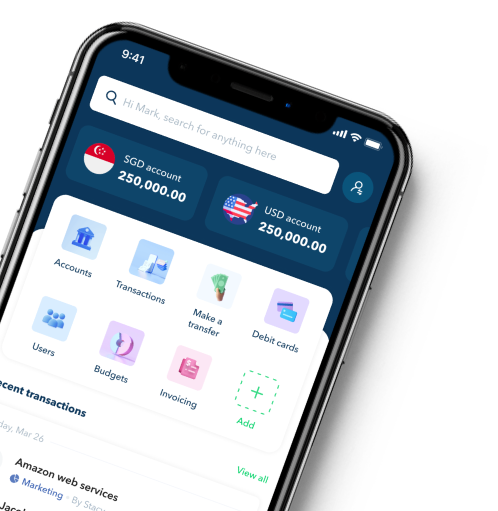

Corporate cards for growing businesses

Issue unlimited corporate cards, one for each member of your team. Empower your team to spend right, while maintaining control with corporate card spend limits and merchant locks.

.avif)

Trusted by 50,000+ modern businesses

Empower your team & scale faster with Aspire corporate cards

Empower your team

Issue unlimited cards to your team, and enable faster and distributed purchasing in a safe and secure manner.

Stay in control

Set and adjust spend limits at anytime. Avoid costly surprises and gain peace of mind.

Boost your cash flow

Access a credit limit to fuel your business growth and manage expenses with confidence (available to eligible businesses)

The corporate card that does everything

Issue unlimited virtual cards to your team instantly

Issue unlimited virtual cards to each employee, merchant, or use-case. Say goodbye to sharing cards or one-time passwords, and hello to faster and more secure purchasing.

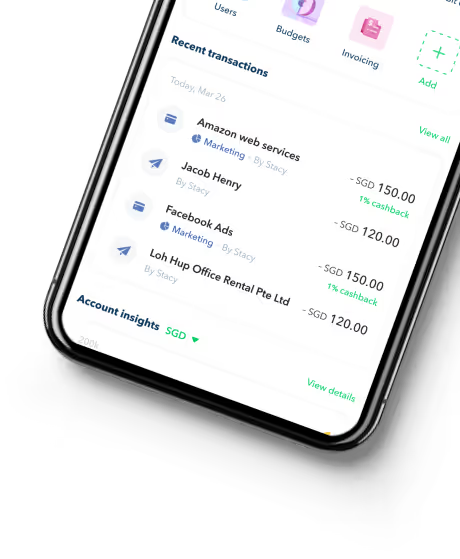

Gain real-time control and visibility of spends on your card

No more overspending or costly surprises. Set spend limits, approval policies, and track spend at your fingertips.

Say goodbye to receipt chasing

Make manual paper chasing a thing of the past with automated receipt reminders and a seamless uploading experience. Access and easily search all your transaction records, all in one place.

Save on FX fees, with multicurrency corporate cards

Leverage market-leading FX rates when you spend with the Aspire card, up to 3x cheaper than banks. Issue Aspire Corporate Cards in multiple currencies, and spend directly in USD or SGD to avoid FX fees altogether. More currencies coming soon.

Earn cashback on your digital spend

Earn 1% cashback on digital marketing and SaaS spend with the biggest names in business tech.

Integrated with your accounting software

Close your books twice as fast, with all transactions synced with major accounting software.

Hear it first from our customers

Gregory Van

CEO of Endowus

Holly Qian

Head of Finance, First Page Digital

William Chong

Finance Director at Glints

corporate card out there

Understanding corporate cards

How corporate cards work

Similar to personal debit or credit cards that are issued to individuals, banks and other financial institutions like Aspire also provide debit or credit cards to corporate entities. Such cards, which are issued to companies or businesses are called corporate cards. The businesses in turn may choose to distribute these corporate cards, among their employees for business-related expenses.

However, the liability to pay any charges that are incurred on these corporate cards is that of the company. Corporate cards make it simple for employees to spend on behalf of the company without paying it out of their own pockets and waiting for reimbursements later. For businesses, it allows them to track expenditures with ease, set limits on card spending, and delegate spending while having control. Corporate cards are also specifically designed to provide numerous rewards and benefits for the company as well as its employees which makes corporate cards very profitable for businesses.

To whom should you issue corporate cards?

Earlier, businesses used to issue corporate cards only to company directors or senior managers. However, this may cause a bottleneck as your company scales as employees at different levels may need to undertake corporate expenses.

The modern approach to issuing corporate cards is by understanding the needs at a role level. Employees in certain roles such as sales, client servicing, purchase or marketing department often tend to spend money on behalf of the company. Also, certain designations like mid-level managers who meet with clients regularly, or need to make business trips frequently on behalf of the company are potential candidates to issue a corporate card to.

Benefits of issuing corporate cards to your employees

With corporate cards, employees are empowered to make financial decisions which are required for the efficient functioning of their roles within the organization. On the other hand, founders can easily track company spending with corporate cards and seamlessly integrate it with other financial processes such as expense management and also their accounting software. Thus, helping businesses to automate and grow faster.

Modern corporate cards are designed to mitigate fraud through multiple features such as transaction limits, category locks, and an option to freeze the card when lost or stolen making corporate cards a safer option to distribute among your employees. By distributing ownership, you also distribute financial responsibilities amongst your employees, who are then responsible for all the spending on their cards. Thus, helping in reducing fraud at large.

Modern corporate cards provide features like automated transaction alerts, expense categorization etc. that aid higher visibility. By distributing cards to their employees, businesses can track all the spending that is happening within the organization at a project level, team level or even an employee level.

Choosing a corporate card for your business

In today’s financial ecosystem, you can avail virtual corporate cards as well as physical corporate cards. Physical cards are the normal tangible cards that have existed in the market for years. Virtual cards are digital cards which reside in your phone, tablet, laptop etc. and have no physical presence even though they function exactly the same as physical cards. While both cards have their own pros and cons, with increasing transactions being done online, virtual cards are replacing physical cards in the market. That said, you need not choose between any one of them, as many providers such as Aspire, offer you the flexibility of owning multiple virtual cards as well as a physical card at the same time at no extra cost.

Corporate cards can exist both as debit cards where your withdrawals are limited to the funds present in your account and also as credit cards where you can withdraw a specified amount as per your eligibility, and repay the same within a specified period. While credit cards are preferred for ensuring smooth cash flow, debit cards are preferred by businesses looking to stay within limits, and in control. Aspire corporate card is a corporate debit card, however, it offers you flexibility to get a credit line on the card, thus providing businesses control as well as extra funds to facilitate a smooth cash flow.

Traditionally corporate cards were designed for companies with high annual revenues, whereas business cards were for smaller companies. But with times changing quickly and the functioning of both companies large or small taking a more global, digital-first approach, the rewards of both corporate cards as well as business cards are gravitating towards providing more and more digital benefits. Instead of deciding on a card by what it is called, it is better to read into the detailed benefits of each card to understand which one will be more suited for your business needs.

Read more on how to choose the best corporate card for your business.

Who offers corporate cards in Singapore?

There are many banks and fintech companies, like ourselves, that offer corporate cards to businesses in Singapore. We have covered them all in our blog, you can click the links to view cards offered by various banks such as DBS, UOB, Citibank, OCBC, Maybank etc.

However, if you are a start-up or a growing business, chances are you may not meet the eligibility criteria for most of these banks or find them to be expensive for your liking. You can consider opting for Aspire Corporate Card which offers you all the benefits, with eligibility criteria which are less stringent. Read our article on the best corporate cards in Singapore for quick and easy comparison.

How to apply for a Corporate card in Singapore

The requirements to apply for a corporate card may vary from one issuer to another. You will have to submit documents such as your business registration details, financials and other information to apply for corporate cards. Some companies may require that you submit your company's credit score too. This will determine the type of cards and the number of cards you will be eligible for.

Applying for digital cards, such as Aspire corporate card, is much simpler since you can complete the whole process online. For instance, to apply for an Aspire card, you simply need to open an Aspire business account, submit documents online, and you will receive approval for your cards.

FAQs about Aspire corporate cards

Is Aspire corporate card a credit or debit card?

Aspire corporate cards are debit cards. We also have Aspire Advance cards, which is a corporate card with a credit line.

What are the card exchange rates?

At Aspire, we want you to pay the lowest rates in the market.- Zero card activation fees- Zero card transaction fees- Best exchange rates, upto 3x cheaper than banks

How does the cashback work?

All Aspire cardholders will enjoy a minimum cashback of 1% on qualified spending (online marketing & SaaS).Our cashback promos are designed to help your business thrive, so take advantage of them!

Cashbacks are computed automatically at the end of each month based on your digital marketing & SaaS expenses. The cashback is then deposited into your business account by the 1st week of next month.

You will receive a separate email notification when the cashback has been processed.PS: You can find out more about our cashback promotions here.

Can I create multiple cards?

You can create multiple cards for directors, employees, and even external individuals such as your accountant at no additional costs.

When issuing an Aspire card to an individual user, you can also name the card for specific company expenses (i.e.Facebook advertising expenses).

How do I give an Aspire card to other users?

As an Admin, you can issue virtual cards to employees with spend limits at no additional costs. For employees already on Aspire, Admins can issue cards in the following ways:

- Click on Debit cards to access your company cards page

- Click on the "+ New card" button to initiate card creation

- Select the user that you would like to create a card for and complete the required fields

- Card is created immediately

You can issue cards during the invitation flow. Do note that Admins will not be able to issue to other account Admins, they can issue a card on their own. Please note, Cards for account Admins (directors) will be created automatically upon account activation.

Can I get a physical card?

Yes. With Aspire, you can now get a physical card at your doorstep.Please note that:

- Cards tagged to an Advance Limit can't be used for ATM withdrawal

- Cards tagged to the SGD/USD account can be used for ATM withdrawals only outside of Singapore (a fee of SGD 5 is charged for every withdrawal)

- The first card per user is FREE! Subsequent cards for the same user are charged with a 15 SGD processing fee

.png)

.png)